15+ pay calculator kentucky

Figure out your filing status work out your adjusted gross income. This income tax calculator can help estimate your average income.

Kentucky Salary Calculator 2022 Icalculator

The basic benefit calculation is easy it is 11923 of your base period wages.

. Rest of Kentucky Print Locality Adjustment. House Bill 2 from 2018 applies to. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky.

Simply enter their federal and state W-4 information as. Customize using your filing status deductions exemptions and more. Well do the math for youall you need to do is enter.

2021 Electronic Filing and Paying Requirements Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and. All you have to do is enter each employees wage and W-4 information and. Payroll Payroll Fast easy accurate payroll and tax so you can save.

Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. 1595 Any federal employees in Kentucky who do not live in an area for which a specific Locality Pay Adjustment has been set will receive the. However below are some factors which may affect how you would expect the calculation to.

For a detailed calculation of your pay as a GS employee in Kentucky see our General Schedule Pay Calculator. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. The process is simple. Find out how much youll pay in Kentucky state income taxes given your annual income.

CINCINNATI-WILMINGTON-MAYSVILLE OH-KY-IN Print Locality Adjustment. We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. House Bill 992 from 2000 applies to injury dates between 7152000 and 7132018.

On the other hand if you make more than 200000 annually you will pay. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Supports hourly salary income and multiple pay frequencies.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky. Kentucky Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Kentucky Department of Workers Claims 992 Table Calculator.

Lyndon Square 55 Senior Apartments 911 Ormsby Lane Louisville Ky Apartments For Rent Rent

400 Reed Ln Simpsonville Ky 40067 Mls 1617697 Rockethomes

What S New Page 2 Of 6 Property Valuation Services Inc

Multifidelity Statistical Machine Learning For Molecular Crystal Structure Prediction The Journal Of Physical Chemistry A

Equestrian Kentucky Derby Table Numbers Winners Horse Race Etsy Uk

Pdf Effect Of Loading On Peak Power Of The Bar Body And System During Power Cleans Squats And Jump Squats

Free 15 Overtime Worksheet Templates In Pdf Ms Word Excel

When Will Student Loan Forgiveness Programs Actually Start Paying Student Loan Hero

4805 E Kentucky Apartments 4805 E Kentucky Ave Denver Co Rentcafe

6999 Old Kentucky Road Sparta Tn 38583 Compass

University Of Kentucky Graduate Student Salaries Glassdoor

Freebsd Handbook

Haley Content Creator Mageplaza

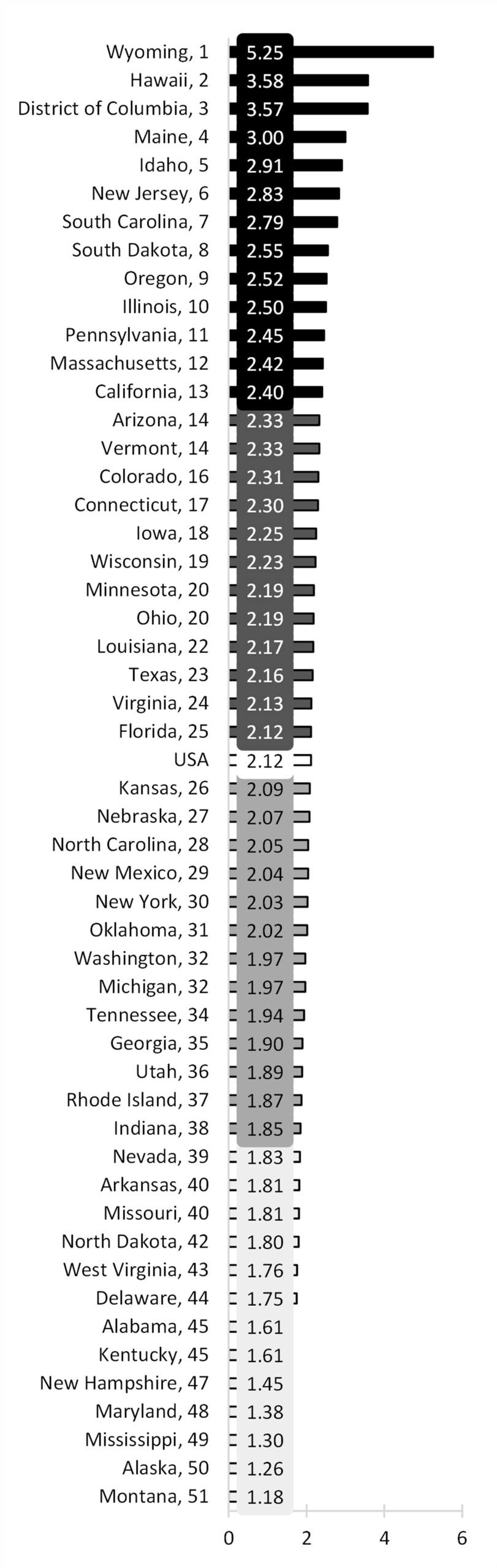

Marriage To Divorce Ratio In The U S Geographic Variation 2020

174 Clay Ridge Road Alexandria Ky 41001 Compass

Crescent Centre Apartments 657 South 3rd St Louisville Ky Rentcafe

Kentucky Hourly Paycheck Calculator Paycheckcity